Where Should US Businesses Look to Diversify Their China Operations

The China Plus One strategy is a way for global businesses to cope with the US-China trade war and the COVID-19 pandemic, by moving some of their production and sourcing from China to other countries, such as Vietnam. This can help them save costs, reduce risks, and access new markets. However, this strategy also has some challenges and requires careful planning and adaptation. In this article, we will discuss why Vietnam is a good choice for the China Plus One strategy.

Why China Plus One?

China has been the dominant manufacturing hub for the world for decades, thanks to its low labor costs, large domestic market, well-developed infrastructure and supply chain network, and supportive government policies. However, in recent years, China’s competitiveness has eroded, as its labor costs have risen, its environmental regulations have tightened, its currency has appreciated, and its trade relations with the US and other countries have deteriorated. The US-China trade war, which started in 2018, has imposed tariffs on hundreds of billions of dollars worth of goods, affecting a wide range of industries and products. The COVID-19 pandemic, which originated in China, has exposed the vulnerabilities of relying too much on a single source of production and supply, as lockdowns, disruptions and delays have affected global trade and logistics. These factors have prompted many companies to reconsider their China-centric strategies and look for alternatives.

The China Plus One strategy is one of the options that companies can pursue to diversify their operations and mitigate their risks. The idea is to maintain some presence and activities in China, while expanding or relocating some production and sourcing to other countries, especially in Southeast Asia or South Asia. These countries offer some advantages that China no longer does, such as lower labor costs, favorable trade agreements, growing domestic markets, and political stability. By adopting the China Plus One strategy, companies can benefit from the following:

- Cost reduction: By moving some production and sourcing to countries with lower labor costs, companies can reduce their operating expenses and improve their profit margins. For example, according to a report by the Japan External Trade Organization (JETRO), the average manufacturing labor cost in China was $6.5 per hour in 2019, compared to $3.4 in Thailand, $2.4 in Vietnam, $1.6 in India, and $1.2 in Indonesia.

- Market access: By establishing a presence and production base in other countries, companies can also tap into the potential of these markets, which have large and growing populations, rising incomes, and increasing demand for various goods and services. For example, according to the World Bank, the combined population of the Association of Southeast Asian Nations (ASEAN) was 655 million in 2019, with a GDP of $3.2 trillion and a GDP per capita of $4,971. The population of India was 1.4 billion, with a GDP of $2.9 trillion and a GDP per capita of $2,104.

Why Vietnam?

Among the countries that can benefit from the China Plus One strategy, Vietnam stands out as a promising destination for investors looking for an alternative to China. Vietnam has several attributes that make it attractive for manufacturing and sourcing, such as:

- Political stability: Vietnam has a stable and unified political system, with a one-party rule by the Communist Party of Vietnam. The government has pursued a policy of economic reform and integration since the late 1980s, opening up the country to foreign investment and trade, and improving the business environment and legal framework. The government has also maintained good relations with most of its neighbors and trading partners, including China and the US, and has avoided major conflicts or crises.

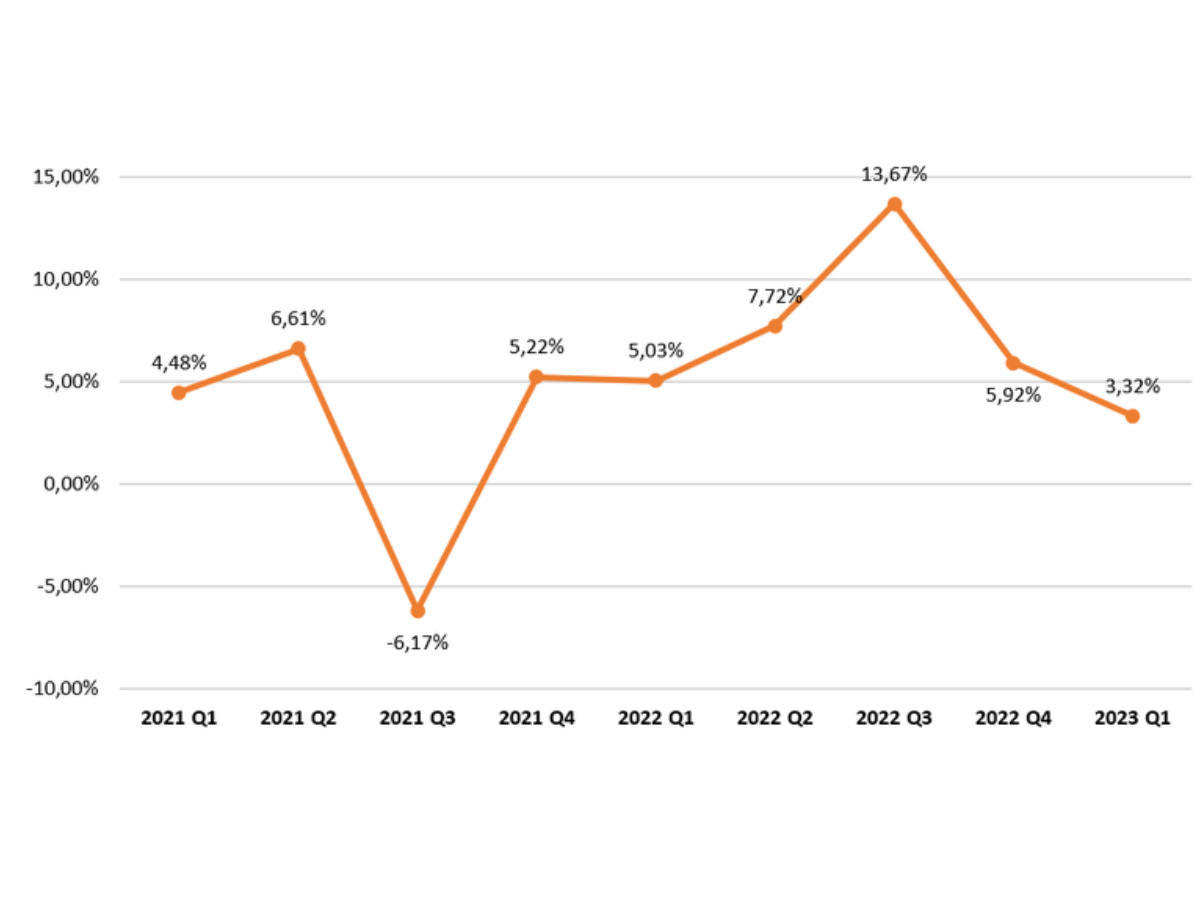

- Economic growth: Vietnam has been one of the fastest-growing economies in the world, with an average annual GDP growth rate of 6.8% from 2015 to 2019. The country has also been resilient to the impact of the COVID-19 pandemic, achieving a positive growth rate of 2.9% in 2020, while most other countries experienced contractions. The country’s economic performance has been driven by its strong export sector, which accounts for about 100% of its GDP, and its domestic consumption, which accounts for about 70% of its GDP.

- Trade openness: Vietnam has been an active participant in the global trade system, signing and implementing several free trade agreements (FTAs) with various countries and regions. These FTAs have given Vietnam preferential access to large and lucrative markets, such as the European Union, Japan, South Korea, Australia, and Canada. Vietnam is also a member of the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), a mega-regional trade deal that covers 11 countries and 13.5% of the global GDP. Moreover, Vietnam has been a beneficiary of the US-China trade war, as it has attracted some of the trade and investment diverted from China, especially in the electronics, textile, and furniture sectors.

- Competitive labor: Vietnam has a large and young labor force, with a population of 97 million and a median age of 32.5 in 2019. The country has a high literacy rate of 95.1% and a high enrollment rate in secondary and tertiary education. The country also has a low labor cost, with an average manufacturing wage of $242 per month in 2019, which is lower than that of China, Thailand, and Malaysia. The country also has a relatively flexible labor market, with a moderate level of labor regulations and protections.

- Infrastructure development: Vietnam has been investing in improving its infrastructure, especially in the areas of transportation, energy, and telecommunications. The country has a network of roads, railways, ports, and airports that connect its major cities and industrial zones. The country also has a reliable and affordable electricity supply, with a high electrification rate of 99.4% and a low electricity price of $0.07 per kWh in 2019. The country also has a high penetration rate of mobile phones and internet, with 147.4 mobile subscriptions and 70.3 internet users per 100 people in 2019.

Challenges and recommendations

While Vietnam offers many advantages for the China Plus One strategy, it also faces some challenges and limitations that investors should be aware of and prepared for. Some of the main challenges include:

- Regulatory barriers: Vietnam still has some bureaucratic and administrative hurdles that can affect the ease and efficiency of doing business in the country. For example, the country ranks 70th out of 190 economies in the World Bank’s Doing Business 2020 report, with low scores in areas such as starting a business, dealing with construction permits, paying taxes, and enforcing contracts. The country also has some restrictions and uncertainties on foreign ownership, land use rights, intellectual property rights, and dispute resolution mechanisms.

- Skill gaps: Vietnam still has some skill gaps and shortages in its labor force, especially in the areas of technical, managerial, and soft skills. For example, according to a survey by the Vietnam Chamber of Commerce and Industry, 85% of the enterprises reported difficulties in finding qualified workers, and 40% of the workers lacked professional and technical skills. The country also has a low level of proficiency in English, ranking 65th out of 100 countries in the EF English Proficiency Index 2020.

- Environmental and social issues: Vietnam still faces some environmental and social challenges that can affect its sustainability and competitiveness. For example, the country is vulnerable to the impact of climate change, such as rising sea levels, extreme weather events, and natural disasters. The country also has a high level of air and water pollution, which can affect the health and productivity of its people and resources. The country also has some social issues, such as income inequality, labor rights, human trafficking, and corruption.

To overcome these challenges and maximize the benefits of the China Plus One strategy, investors should consider the following recommendations:

- Conduct thorough research and due diligence: Investors should conduct comprehensive research and due diligence on the market conditions, legal framework, industry trends, and potential partners and suppliers in Vietnam. They should also consult with local experts, advisors, and authorities to obtain accurate and updated information and guidance.

- Choose the right location and sector: Investors should choose the location and sector that best suit their needs and objectives, taking into account the availability and cost of land, labor, infrastructure, and incentives. They should also consider the regional and global value chains and market access that Vietnam can offer, and the competitive and comparative advantages that they can leverage.

- Adapt and innovate: Investors should adapt and innovate their products, processes, and strategies to the local context and preferences, as well as the changing dynamics and opportunities in the region and the world. They should also embrace digital transformation and automation to enhance their efficiency and quality.

If you are looking for a reliable partner to invest in the Vietnamese agricultural market, please contact us immediately. WTPAgri will ensure to bring you satisfaction during the cooperation process with the highest goodwill and quality.

Contact our team at agri.crm@wtp.vn or call us at +84971279099. And remember that we can also provide tailored service if you need it.

News Related

- Dried Fruits Import: Attractive Business Opportunity for International Businesses

- 5 delicious and refreshing nata de coco drink recipes

- A step forward in bilateral cooperation between Vietnam - the United States

- Advantages of shifting the fruit juice supply chain to Vietnam

- Aloe Vera Juice – Manufacturer and Supplier

Vietnamese

Vietnamese  Korean

Korean Japanese

Japanese Chinese

Chinese